2024/03/22

The U.S. House of Representatives passes a $1.2 trillion appropriation bill to avoid a partial government shutdown

If the bill is not passed by the Senate, the US government will be forced into a partial "shutdown" on the morning of the 23rd.

More⋯

2024/03/22

Apple is doing "subtraction": it will not build cars, and it will not build microLED watch displays!

According to people familiar with the matter, Apple will cut dozens of display engineer positions in the United States and Asia. The reason for the termination of the project was that the cost and complexity were too large to achieve mass production scale. This decision was basically made at the same time as Apple’s previous decision to cancel the development of electric vehicles.

More⋯

2024/03/21

The first developed country to cut interest rates: Switzerland!

Some believe that the Swiss National Bank's move will amplify the possibility of the Federal Reserve and the European Central Bank cutting interest rates this year. Tonight, the Bank of England and the Norges Bank will announce their latest interest rate decisions.

More⋯

2024/03/21

European stocks rose, U.S. stock futures rose, U.S. CD-ROMs rose more than 18% before the market opened, and gold broke through the $2,200 mark.

The Federal Reserve's "dove announcement" boosted risk sentiment, the Swiss National Bank fired its first shot at cutting interest rates, and the Bank of England "kept on hold" tonight.

More⋯

2024/03/21

Micron's HBM3E for this year and next is almost sold out. Hynix and Samsung surged after hearing the news, and Nvidia Blackwell is so strong!

"Strong signal of booming demand for Nvidia's Blackwell chips."

More⋯

2024/03/20

The Federal Reserve continues to remain on hold as scheduled, maintaining its expectations for three interest rate cuts this year and warning that interest rates will be higher than expected in the future.

The Federal Reserve held interest rates for five consecutive meetings, reiterating that it was more confident about inflation before cutting interest rates. The dot plot shows that the number of Fed officials expected to cut interest rates three times this year increased from three to nine, and the number of Fed officials expected to cut interest rates four times fell by three to only one. Federal Reserve officials' median interest rate expectations for this year remained unchanged from last time, with interest rates still expected to be cut by 75 basis points this year, and interest rate expectations for next year and longer term to be raised by 30 basis points, 20 basis points and 10 basis points respectively. The Fed significantly raised its GDP growth forecast for this year from 1.4% to 2.1%, slightly lowered its unemployment rate forecast to 4.0%, and raised its core PCE inflation forecast from 2.4% to 2.6%.

More⋯

2024/03/20

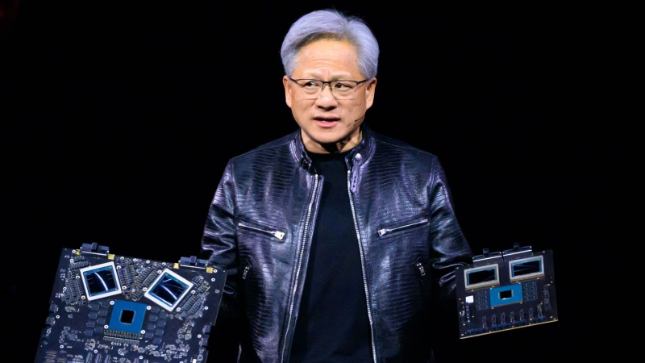

Jen-Hsun Huang’s latest interview: Blackwell chips are priced at US$30,000-40,000. The climb of artificial intelligence has just begun. Unprecedented progress will be seen in the next 10 years.

AI running on NVIDIA hardware has an impact on humanity just like the invention of electricity did to humanity. Although the market share has reached 85%, NVIDIA's contribution to AI is still underestimated.

More⋯

2024/03/20

The Fed still expects to cut interest rates three times this year, U.S. stocks, U.S. bonds and gold rise

The yield on the two-year U.S. Treasury note plunged about 7 basis points to a new daily low, approaching 4.6%. The price of gold rose by about $8, setting a new daily high and approaching $2,166. The S&P and Dow expanded their gains to nearly 0.3%, and the Nasdaq rose about 0.5%.

More⋯

2024/03/19

NVIDIA fell 4% and then rose 1%, pushing the S&P to close at a new high, while the yen collapsed and hit its lowest level in four months

Nvidia led the fluctuations in large technology, AI and chip stocks. The S&P Nasdaq stopped falling and turned positive in the afternoon. The Dow Jones Industrial Average rose the most in three weeks. However, the chip stock index fell for five consecutive days to a two-week low. AMD fell about 7% and closed down nearly 5%. , Oracle hit new highs in two days. The China Concept Stock Index narrowed its losses, with Xpeng Motors closing up 0.7% after opening 7% higher. Before the Fed's decision, U.S. bond yields fell by about 5 basis points, and the 10-year bond yield fell from its highest level in nearly four months. Oil prices have remained at five-month highs for two consecutive days, with Brent oil closing above $87 and U.S. oil rising nearly 1%. The U.S. dollar index hit a two-week high. The Bank of Japan ended negative interest rates and YCC policies, but the yen fell to 151. Bitcoin once fell 7% and fell below $63,000.

More⋯

2024/03/19

Huang Renxun confidently said: The data center business is 250 billion a year, and Nvidia will grab most of the "cake"

Huang Renxun said that the annual global investment in data center equipment will total US$250 billion, and the share of NVIDIA products will exceed that of other chip manufacturers. He expects software to be a very large business. Nvidia's stock price, which fell nearly 4% in early trading, turned higher and closed up more than 1%.

More⋯

2024/03/19

Big news in the currency circle: The world’s largest pension fund is exploring Bitcoin, and Bitcoin on one exchange crashed to over $9,000

During a period of insufficient liquidity, a seller sold more than 400 Bitcoins to the market in a short period of time, triggering a flash crash on the BitMEX platform, once falling below an astonishing $9,000. At the same time, Bitcoins on other exchanges were still Above $66,000. Japan’s Government Pension Investment Fund, the world’s largest pension fund, announced that it will explore the possibility of diversifying part of its investment portfolio into Bitcoin.

More⋯

2024/03/18

Nasdaq 100 index futures rose more than 1%, European stocks opened higher, and Google rose more than 5%

The three major U.S. stock futures indexes collectively rose, with Nvidia rising by more than 2%, Tesla rising by nearly 4%, Xpeng Motors rising by more than 6%, and Bitcoin rising above $68,000.

More⋯

2024/03/18

Elon Musk’s “unspeakable secrets” and “ambitions” of open source Grok

In the future, the "siphon effect" of large-scale base models will become more and more obvious, leaving few opportunities for other players. If Grok, which has not entered the first echelon, continues to follow the closed-source path, it will only be a matter of time before it is abandoned.

More⋯

2024/03/18

The GTC conference is about to open, the three major U.S. stock indexes opened higher, and Google A rose more than 5% at the opening

Nvidia rose 3.4%, and Google parent company Alphabet opened up 5.8%.

More⋯

2024/03/15

The three major U.S. stock indexes collectively opened lower. Adobe fell more than 12% after releasing its financial report, and Nvidia continued its correction.

Microsoft and Amazon fell more than 1%, chip stocks continued to correct, Nvidia fell 1%, and TSMC fell more than 2%. Bitcoin quickly returned above $68,000.

More⋯

2024/03/15

Goldman Sachs: Nvidia is just the beginning, there are three major stages of AI investment worth paying attention to

The next three stages include the infrastructure stage, the "AI empowered income" stage, and the "productivity improvement" stage. Investors may quickly trade stocks in the first two stages, while stocks in the fourth stage have greater room for long-term growth.

More⋯

2024/03/15

Are Middle Eastern tycoons entering the game? Report: UAE investment company MGX is negotiating to invest in OpenAI chip company

It may become a key step for OpenAI to realize its "chip empire" ambition.

More⋯

2024/03/14

Inflation is stubborn! U.S. PPI rose 1.6% year-on-year in February more than expected, and core PPI accelerated month-on-month rise

The U.S. PPI heated up more than expected in February, with year-on-year growth hitting the highest level since September last year, and month-on-month growth accelerating by 0.6%, which was twice the expected value.

More⋯